Further, Facebook says companies like Uber and Visa are likely to join. To avoid volatility and privacy concerns, Libra will be backed by real-life assets. The service would enable quick payments across the world, and available as both an app and messaging service in 2020. If successful, Facebook’s currency could cause a major shakeup in the financial world, but that comes with its own concerns. The company has already received numerous accusations of a monopoly-like status and calls for it to be broken up. It has also been at the head of data privacy scandals in recent times, from Cambridge Analytica to Facebook and Instagram breaches. To address this, Facebook has formed the Libra Association, a collection of financial, not-for-profit and commerce firms that will form the decision-making backbone. Regulators and users are supposed to believe that the firms, who contributed a minimum of $10 million to be on the board, have their best interests at heart. Companies in the association include PayPal, Mastercard, Coinbase, Uber, Lyft, and Mercy Group. Facebook claims this association will be independent from governments and its own company to stop tampering.

What are the advantages of Libra?

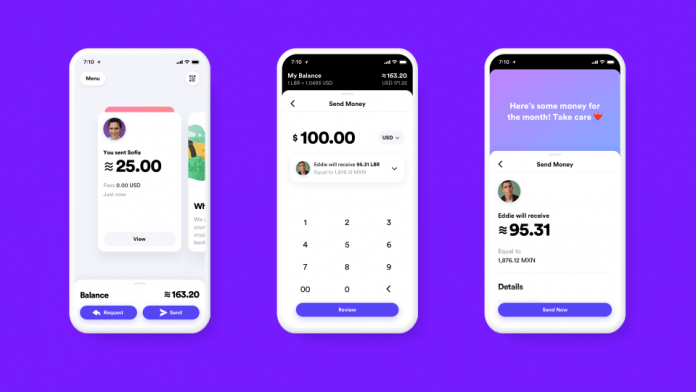

Of course, there’s currently little Libra is offering that first-world users can’t do via mobile banking or other payment systems. The main advantage of Facebook’s effort is that it won’t require a bank account or phone number, nor have the substantial fees of PayPal. Despite this, the company is promising Libra will have similar support. It will use similar anti-fraud processes to banks or credit cards, while giving refunds to users who have their currency hacked or stolen. As for privacy, it’s unclear where exactly users will stand. Facebook says it won’t be tying Libra user data to its social platforms, nor will it have access to the transaction information. Its Libra subsidiary, Calibra, says user data won’t be shared with third-parties “without customer consent”, or use it to target ads. However, there’s still plenty of grey areas those statements don’t cover. Initially, payments on Libra will be verified via a private blockchain, though that will change in the future. Analysts seem to believe this could turn into a big earner for Facebook, while the low-fees could power a micro-payments system that moves away from the somewhat shaky advertising market.